What’s in a name? Over the years, coming up with original company names has become next to impossible for start-up companies. If you’ve noticed a lot of odd-sounding names for prescription medicines in advertisements in recent years, you can probably relate. Ever heard of Skyrizi, Avycaz and Remdesivir? While the prescription medicine world must adhere to regulatory naming conventions, they also encounter the same issue many start-up companies face—established brands have already taken most of the “normal-sounding” good company names.

When a team of academics from Stanford University started Infima, they thought about many different names. They wanted to find a name that could be pronounced and spelled, and they also wanted it to mean something. This is no small feat to accomplish in this day and age.

So, what does Infima in “Infima Technologies” actually mean? For those of us at Infima, we look at our name in three ways:

Infima, a Mathematical Definition

In mathematics, the infimum (infima as plural) is the greatest lower bound; one can think of it as the minimum.

Infima, the Acronym

To those of us on the Infima Technologies team, we also know that Infima is the acronym we use for “Intelligent financial machines,” which are machines that can learn about financial data. It is pronounced as [ˈɪn fe mə], and it’s also why we call the company “Infima Technologies.”

Intelligent – Infima’s technology continuously learns and shares insightful analysis.

Financial – Infima’s solutions process fundamental financial data.

Machines – Infima uses machine learning, specifically deep learning, to find patterns (i.e., opportunities) that might be missed with more conventional solutions and models.

Infima’s Core Strengths

In addition to the mathematical definition and the acronym behind the Infima name, it also represents the core strengths of our technology, including:

Minimal prediction error

Minimal latency (of application)

Minimal compute cost

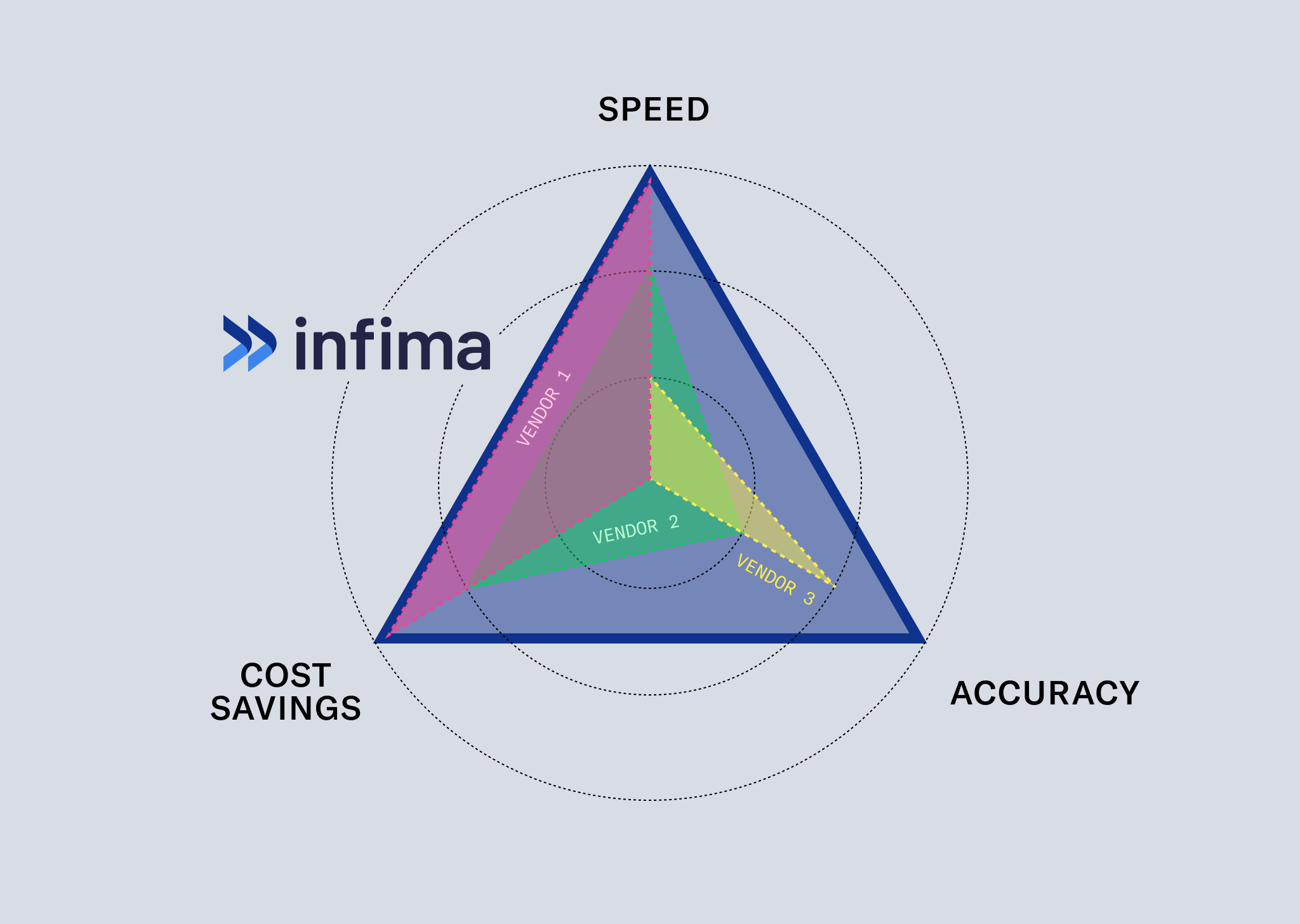

If you look at Infima versus incumbent or traditional players in the MBS analytics space (as shown in the graphic below), you can see that Infima hits the mark on speed, accuracy and cost savings fronts. It happens to be something we can only accomplish with deep learning.

Infima offers the only solution that delivers on all fronts: speed, accuracy and cost savings.

We believe that our name fits and that deep learning, as a subset of machine learning, is essentially a neural network of multiple layers. These neural networks aim to simulate the behavior of the human brain—in this case, to draw insights from patterns and to learn from billions of data points. Infima’s deep learning layers make its insights more accurate than what can be created through traditional or parametric analysis.

And why does that matter, you might ask? Well, machines that can learn from patterns in metrics based on years and years of financial data means that those pattern-detection capabilities can also help investment research analysts, traders and portfolio managers to make better investment decisions with better information that’s not humanly possible to analyze in the same way. Infima’s insights can be additive, allowing investment professionals to integrate them into existing models or find areas to delve into further research and give them a competitive edge. Now we’re seeing momentum in the market with some of the country’s largest banks using Infima’s solutions, and we think they’re pretty intelligent for doing so.

Stay tuned for a follow-up article on how Infima Technologies got started, but for now, feel free to read our story.