Which story is true?

Our last article, “Selecting Attractive Pools Using Infima’s Tools- Part I,” highlighted a method to evaluate relative value across the coupon stack with OAS+ metrics from Infima. Now we focus on the middle of the stack – the 3s and 3.5s – and explore stories there that could be trading cheap for what they are worth.

Given the fast home price appreciation (HPA) through the pandemic, loan balance (LB) stories have been more limited in supply. This technical factor makes them rarer to find and, as a result, rising in value for investors looking for higher rate volumes to make their investments worthwhile. Furthermore, LB stories offer both extension and call protection, making them a potential Goldilocks profile in this uncertain rate environment. On the one hand, because the mortgage universe is deeply out of the money, investors seek higher prepayment speeds. On the other hand, as the Fed’s tightening cycle is near complete while recession risks stay high, investors would also see the value of call protection should rates rally.

Loan balance stories offer this two-sided convexity advantage because of their lower rate sensitivity. Borrowers with lower loan balances have fewer absolute dollars to lose or gain when they refinance. Even when current market rates are higher than borrowers’ mortgage rates, borrowers with longer home ownership may still cash out on their home equity, as these borrowers typically have smaller loans. Alternatively, such balances may be associated with younger borrowers ready to trade up their homes. Both suggest greater turnover. And when these borrowers are in the money to refinance, the lower absolute dollar savings represent less incentive. Lower loan balances can therefore provide stable prepay profiles.

The optimal cut

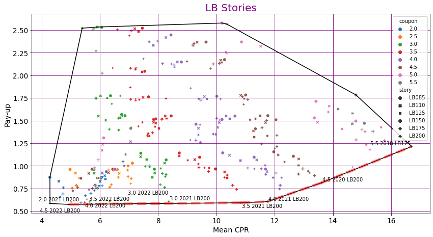

Within loan balance stories, there is still a wide variety of cuts, servicers, and seasoning. For instance, loan balance limits can range from 85k to 200k. To shop for pools with the highest projected speeds and the lowest pay-up, Infima provides a suite of solutions for fine-tuning the analysis across cohorts and vintage. For example, the Efficient Frontier is a relative-value framework that can assist investors in finding the optimal cohorts constrained by a set of criteria. Infima will soon publish a whitepaper on an Efficient Frontier framework for mortgage-backed security (MBS) investments. Exhibit 1 below shows the story cohort pay-up vs the 6M average Constant Prepayment Rate (CPR) projection for loan balance stories. The dashed red line is the Frontier consisting of cohorts that maximize on their projected 6-month speeds while minimizing on the pay-ups.

Exhibit 1: The 175k max and 200k max cohorts from 2021 stand out on the Efficient Frontier

Source: Infima Technologies, Inc.

For 3s and 3.5s, 200k cohorts with 2021 vintage seem to maximize speeds while keeping pay-ups as low as possible. In fact, when we zoom into each coupon shown by color, we notice that cohorts with lower pay-ups tend to have higher CPRs, especially for pay-ups less than 1.25 percentage points. This is confirmed by recent speed prints where higher loan balance pools such as 175k and 200k show speeds comparable to 85k, if not better. In October, speeds for 200k 3.5s with 2021 vintage came in at 7.0 CPR, about 0.1 CPR above the speeds for 85k 3.5s with 2021 vintage.

Taking calculated risk

On Infima’s web-based UI, we zoom into FNCL 3.5 2021 LB200 - a cohort we like - to look at specific pools forecasted to prepay faster. Sorting the Pools tab by Pred 6m CPR in descending order, we see the fast-paying pool FR RA5746. It is projected to prepay at 12.6 CPR on average in the next six months, if rates stay in the current range.

To be long in these pools, we must consider hedges to protect our position against adverse market movements. A natural choice is to sell To-Be Announced (TBAs) against buying the pools. The OAS on FR RA5746 is currently 123 bps, whereas the OAS on the Fannie 3.5 TBA is around 104 bps. The pickup in spread is around 20 bps. We then use OAD to calculate the hedge ratios. According to Infima’s calculations, the OAD of the TBA and pool are about 5.2 and 5.0 years, respectively. If the TBA were trading around $91-15 and the pool around $91-25, the hedge ratio would be about 0.95 to 1. This would mean that for a $10-million long position in the pools, investors would need to sell $9.5 million in 3.5 FNCL TBA to remain DV01 neutral.

The worst that can happen in this strategy is losing the entire pay-up, which at around 10 ticks would be relatively small, while the upside has much more potential. In fact, this type of strategy considers pay-up as a cheap option. Leveraging Infima’s scenario engine, we see that average projected 6-month speed will likely rise from 12.6 CPR to 13.9 CPR if rates rally by 25 bps. That would mean about 130 bps in additional return after a year. If rates rally by 50 bps or 100 bps, pay-ups would likely rise by 3 to 5 ticks. And if rates rally by 200 bps, pay-ups can nearly double to 20 ticks for 2021 vintage 200k 3.5s, as was the case around April this year.

Finally, we can set thresholds based on OAS for timing this strategy. Since the market has priced in hawkishness of the Fed in the near term but expects easing starting in June next year, now may be a good time for investors to enter this trade. In fact, some money managers have already stepped back into the MBS market the last few trading sessions, tightening the mortgage basis to 139 bp on November 23, the lowest in more than 12 weeks. For fading this trade, investors can calculate equal OAS pay-up, which assumes the pool shares the same OAS as TBA. If the trading pay-up relative to the theoretical pay-up rises beyond a certain ratio, then the pool would no longer be considered cheap. Investors can then consider exiting to realize the appreciation in price.

Accurate predictions of prepayment speeds are critical for security selection, portfolio construction and risk management in Agency MBS markets. Infima’s transformative deep learning technologies set new prediction standards, delivering performance boosting edges to MBS market participants including investors and dealers.